For a manufacturing industry the challenge is always to determine the right product mix and to price products in the right way to achieve the desired profit margin. It is crucial for organizations to keep track of the levels of inventory, production costs and profitability to maximize profits and minimize wasted cash flow. A costing method is the framework for effective monitoring of these parameters. Costing methods for manufacturing are accounting techniques that are used to help understand the value of inputs and outputs in a production process. The right product costing methods in manufacturing helps to make informed decisions about production levels, pricing, competitive strategy, future investment, and a host of other concerns.

All manufacturing environments have a specific costing and pricing philosophy that guides them in the selection of the right costing methodology to employ. However two important Costing help in finding Manufacturing Costs. They are Inventory Costing and Product Costing

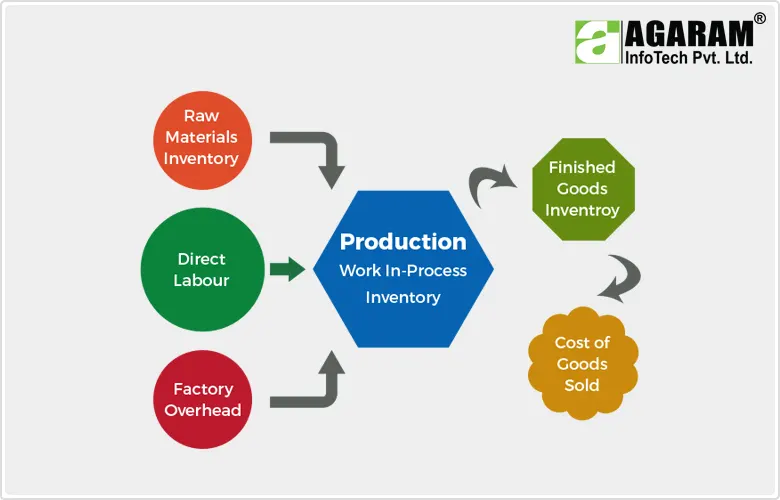

Inventory includes the raw materials, work-in-process, and finished goods that a company has on hand for its own production processes or for sale to customers. Inventory is considered an asset for the business and the valuation of inventory has a direct bearing on the amount of expense charged to the cost of goods sold in an accounting period, and therefore on the amount of income earned. The product costing methods in manufacturing takes in to account the cost assigned to the inventory at hand and there are several costing methods to ascertain that:

First-in, First-out (FIFO) – FIFO determines the price of inventories based on the date they were received or the date of manufacture. Businesses that trade in foodstuffs and other goods generally use the FIFO method. Since the goods have a limited shelf life the oldest goods need to be sold before they pass their sell-by date.

Last-in, First-out (LIFO) – This method determines the price of inventories under the assumption that the last item of inventory purchased is the first one sold.

Weighted Average - The weighted average cost method is most commonly used in manufacturing businesses where inventories are piled or mixed together and cannot be differentiated, such as chemicals, oils, etc. In this method you work out an average cost per unit at each point in time after a purchase.

Specification identification – This determines the specific cost of each item used in the production process or sold. This method is effective for companies that purchase expensive items.

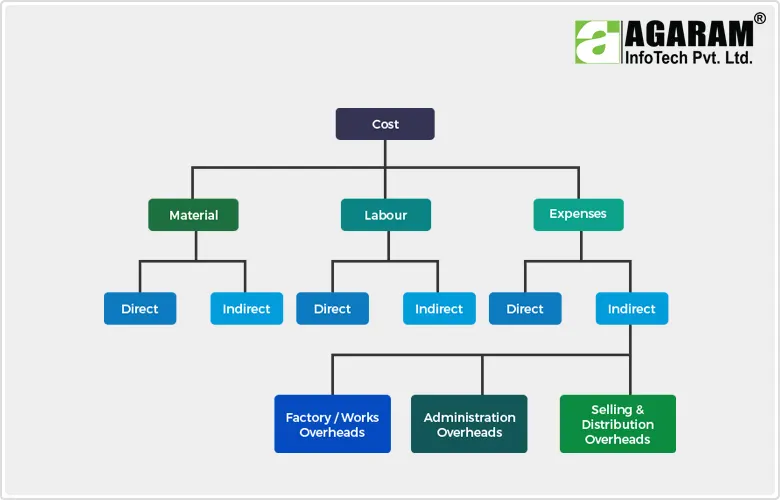

Product Costing methods in manufacturing involves techniques that evaluate the various components and activities involved in production; finding Manufacturing Costs and determining the optimal product cost. There are number of varying Costing methods for manufacturing to choose from, the major production costing approaches employed are as follows:

Job costing (variable costing) considers the materials, labor and overhead costs and maps them to a production process to determine the cost. This type of costing is used primarily by make-to-order production environments.

This is one of the most common costing methodologies employed by manufacturing operations. Here the organization establishs "standard" rates for materials and labor that are used in production and / or inventory.

This method aligns an organization’s resources and their activity to the company’s products and/or services as it relates to their cost consumption. This incorporates more indirect costs into direct production activities to help drive pricing decisions.

Direct costing is a costing methodology that only looks at variable costs (i.e. costs that increase or decrease proportionally with production output). It does not consider fixed costs.

Target costing takes a different approach to costing; for unlike other methods this attempts to predict future costs and how those costs impact product pricing and desired profit margins.

Let us analyze the benefits and drawbacks of these Costing methods for manufacturing

| Costing Methodology | Advantages | Disadvantages |

|---|---|---|

Job Costing |

|

|

Standard Costing |

|

|

Activity - Base Costing (ABC Costing) |

|

|

Direct Costing |

|

|

Target Costing |

|

|

The costing model that is best for your organization is a cost-benefit relationship decision. It is essential to weigh the burden of accumulating the costing information be it past data or future trends, against the ease of use of the method in achieving their desired profit margin. For organizations that produce relatively few products, or products that are engineered/make-to-order, prior cost information is updated relatively frequently. The historical costs would be fairly accurate and as a result job costing or direct costing may be the right approach. With organizations that have a wider array of products or mass produce similar products, there is considerable difficulty in finding Manufacturing Costs and directly associating costs to a specific product, so standard costing or ABC Costing would likely be a better approach.

Each of these product costing methods in manufacturing has virtues that can help drive accurate pricing decisions. Each of these methods would address the requirements of different production and decision environments; for example, a costing method designed for incremental pricing decisions may not be suitable for long-term decision making. The type of costing method used can result in substantial differences in costs; however in the present day scenario it is not necessary to choose one methodology at the expense of another. Highly Comprehensive and efficient Manufacturing Solution offers a hybrid functionality that crosses traditional costing methodology lines. These solutions incorporate functionalities of multiple costing disciplines that help them to achieve accurate pricing decisions. Make the smart choice to choose software solution that incorporates the necessary range of costing functionality / features to help you drive more informed pricing decisions.