The manufacturing sector is one of the major contributors of a country's economic development. In the year 2015-16 it has contributed around 16% to the overall GDP of the nation. However the Indian manufacturing domain has been floundering owing to a complex tax structure that has been a major barrier in its performance on a global scale. The complex Taxation system followed in India consists of direct taxes and indirect taxes. The Manufacturing sector is majorly governed by the Indirect Taxes regime.

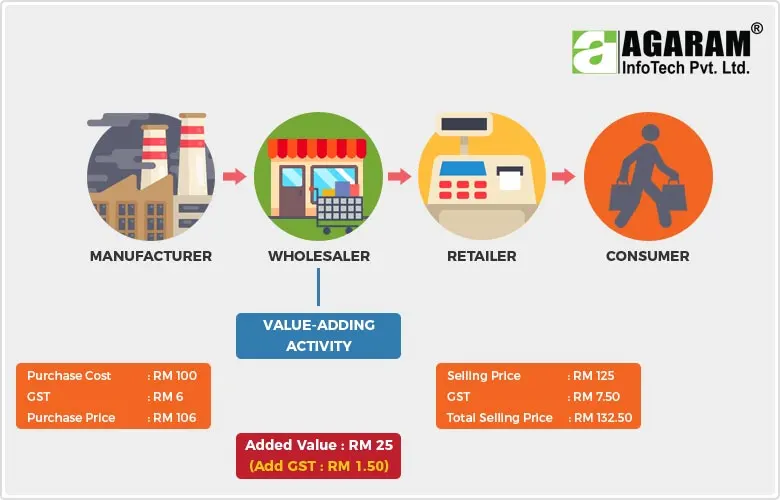

However, this sector sees hope by the implementation of GST. The Goods and Service Tax system is an indirect taxation system which would simplify the present tax regime and merge it into a single taxation system. Before GST was levied, tax on tax was calculated and it was paid by every purchaser including the final consumer. This issue of ‘Taxation on Tax’ is called the Cascading Effect of Taxes and the value of the item keeps increasing every time this happens. GST avoids this cascading effect as tax is calculated only on the value add at each stage of the supply chain.

The basic principle is to tax the value addition at each transaction. The implementation of this unified taxation system will be a positive step and will help the manufacturing sector to stand up and recover.

The new GST model will unify the Indian market. There are 3 applicable taxes under GST: CGST, SGST & IGST

Sale within the State (Intra-state) - The tax levied will be CGST + SGST and the revenue will be shared equally between the Centre and the State.

Sale to another State (Inter-state) - There will only be one type of tax (central). The Center will then share the IGST revenue based on the destination of goods. Inter-State trade will benefit as the interstate transactions do not have to be taxed twice. This is in contrast to earlier taxation regime where if you purchased goods from Chennai you pay tax there and then again in the other state in which you sell it. These will help the traders to increase their Inter-State trade by lowering tax burden. GST would open newer avenues for inter-state sales of Goods and Services. Finally India is about to embrace the 'one nation, one market, one tax' regime.

The aim of GST is to remove the tax barriers between the states to enable free movement of goods and thereby increase the rate of goods movement across states. The Electronic Way (E-way) Bill system in GST makes toll booths unnecessary and hence eliminates the requirement of permits at state border checkpoints. All these factors assist the smooth flow of goods within the country.

As GST replaces all indirect taxes, the location of warehouses will be driven by consumption patterns and customer requirements rather than tax-friendly locations. This will result in the consolidation of warehousing facilities, i.e. the number of warehouses will be reduced but they will emerge to be bigger, more efficient and better managed. These sophisticated warehouses would offer advanced processes and the latest technology.

Since warehouse locations are decided based on logical factors like proximity to consumption centers, manufacturing locations, optimization of goods movement, and inventory control strategy, the turnaround time for road transport will reduce significantly. Quick and timely delivery of goods will reduce inventory and encourage 'Just-in-Time' manufacturing and supply, which would significantly improve the financial health of the business enterprise and reduce the pressure on the working capital.

GST removes the cascading effect of taxes. This reduces raw material cost, warehousing costs and production cost. Dharmesh Panchal, partner-indirect tax, PricewaterhouseCoopers India, says , "In today’s system, production of goods is taxed and the rates are high. Moreover, tax on tax adds to the cost build-up. With GST, overall taxes on goods are likely to come down making them cheaper." It is expected that after GST, the prices of manufactured products will decrease by 10% to 12%.

The decision of setting up business / logistics / warehousing location will now be dealt by geographical positioning and not on tax based decisions. Many new locations will come up as attractive warehousing or logistic bases. Ultimately this savings will pass into the supply value chain and help in optimizing end product cost.

Implementation of Goods & Service Tax (GST) will lead to easy tax administration, increased compliance and revenue. This reformed, simple and transparent tax structure would attract more foreign direct investments across sectors especially in heavy engineering and automotive sectors, due to tax transparency and ease of doing business. Reduced logistics cost, supply chain efficiency, reduction in costs for tax & regulatory compliance, better penetration of markets and export effectiveness are major factors which ensure investors a better return on their investments.

Tao Zhang, Deputy Managing Director of the International Monetary Fund remarks "We expect that the Goods and Services Tax (GST) will help raise India's medium-term growth to above 8 per cent, as it will enhance production and the movement of goods and services across Indian states”.

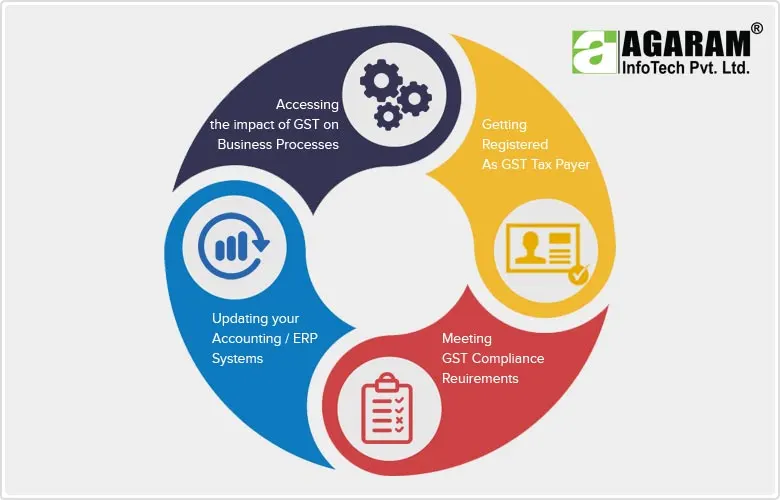

So it is a well acknowledged truth that with the new GST, the cost of manufacturing goods is expected to reduce while the consumption goes up. It’s the right time to get your business GST ready.

GST enforces a very high level of compliance. Hand-written ledgers, accounting books and invoices will have to be done away with. All these will now have be online and will need to be updated regularly. Businesses will have to file 37 returns in a year (three returns per month and one annual return) per state. If there exists offices in multiple states, the number of returns will go up accordingly.

GST requires automation of your invoice generation and filling. Invoices would consist of more than 20 fields such as HSN code, GSTIN of supplier etc., and these invoices need to be uploaded on the GSTN portal on a monthly basis. Since the volume of transactions is high, the manual billing system may not suffice, hence the need for dependable invoicing software arises. Also, to enable your customer to claim input tax credit on their purchases, the invoices they receive should be GST compliant. So GST makes an End-to-End GST Compliant Software for bookkeeping, Invoicing, return filing, payment, reporting, and tax credit claim mandatory. Make the right choice and experience the ease of doing business in a simpler tax regime with reduced multiplicity of taxes.

GST subsumes all in-direct Taxes into one comprehensive tax and makes India an Unified market. As the government aims to make the GST tax system web-based all payments, registrations, refunds and returns would go digital. Hence in order to be GST compliant businesses have to adopt advanced enterprise solutions. So the choice of the right and robust GST-ready ERP software to automate the business processes is the vital factor that would decide the course of your business in the journey to Success.